In today’s fast-paced world, the ability to accept credit card payments on the go is essential for businesses of all sizes. Square, a leading financial services and mobile payment company, has revolutionized this process with its simple and affordable card reader solutions. But how exactly does a Square card reader work? Let’s delve into the inner workings of this technology, exploring the steps involved in a typical transaction and the security measures in place to protect your business and your customers.

The Hardware: A Compact Powerhouse

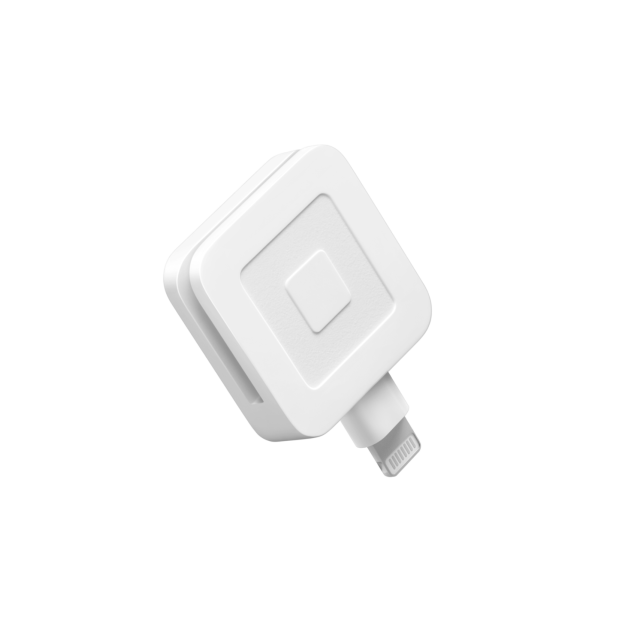

Square offers a variety of card reader options, each catering to different needs. The most common is the free Square Reader for contactless and chip (2nd generation). This compact device plugs directly into the headphone jack or lightning port of your smartphone or tablet. It features a magnetic stripe reader for older cards with swipeable magnetic data and an integrated chip reader for newer EMV (Europay, Mastercard, and Visa) chip cards. Additionally, it boasts near-field communication (NFC) technology, enabling contactless payments through Apple Pay and Google Pay.

The Software: Square App – Your Payment Processing Hub

The magic behind the Square card reader lies in the free Square Point-of-Sale (POS) app. Available for iOS and Android devices, this app serves as the central hub for all your payment processing needs. Once you download and set up the app, it seamlessly connects with your Square card reader.

The Transaction: A Secure Flow of Information

When a customer makes a purchase, here’s what happens behind the scenes:

-

Swipe, Dip, or Tap: The customer inserts their chip card into the reader or swipes their magnetic stripe card. For contactless payments, they simply hold their phone or wearable device near the reader’s NFC area.

-

Encryption: Regardless of the payment method, the card information is instantly encrypted by the Square reader. This encryption scrambles the data, making it unreadable to anyone who might intercept it.

-

Tokenization: An additional security layer comes in the form of tokenization. Instead of transmitting the actual credit card number, a unique token is generated and sent to Square’s secure servers for authorization. This token acts as a pseudonym for the real card number, further safeguarding sensitive information.

-

Authorization: The encrypted token and transaction details are securely transmitted to Square’s payment processing network. This network then contacts the issuing bank to verify the card’s validity and available funds.

-

Approval or Decline: The issuing bank sends an authorization response back to Square. If approved, the transaction is complete, and a receipt can be printed or emailed to the customer. If declined, the Square app will notify you of the reason for the decline.

Settlement: Getting Your Funds

Once a transaction is approved, the funds are deposited into your bank account within one to two business days. Square charges a processing fee for each transaction, typically a flat rate plus a per-transaction fee. You can find the latest fee structure on the Square website.

Security Measures: Keeping Transactions Safe

Square takes security very seriously. Here are some of the measures they implement to protect your business and your customers:

-

PCI Compliance: Square is PCI (Payment Card Industry) compliant, adhering to rigorous industry standards for data security.

-

Fraud Prevention: Square employs advanced fraud prevention tools to monitor for suspicious activity and protect against unauthorized transactions.

-

Tokenization: As mentioned earlier, tokenization ensures that sensitive card data is never stored on your device or Square’s servers.

-

Encryption: All communication between your Square reader, the Square app, and Square’s servers is encrypted using industry-standard protocols.

Additional Features: Beyond Simple Payments

The Square app offers a variety of additional features that can streamline your business operations. These include:

-

Inventory Management: Track your inventory levels and receive low-stock alerts.

-

Sales Reporting: Gain valuable insights into your sales trends and customer behavior.

-

Customer Management: Create customer profiles and store important information for future transactions.

-

Employee Management: Manage employee permissions and track individual sales performance.

Discuss the verification process for preventing fraudulent transactions

While Square card readers provide a convenient way to accept payments, security remains a top concern for businesses. Fortunately, Square implements a multi-layered verification process to combat fraudulent transactions and protect both your business and your customers. Let’s delve into the key elements of this robust system:

Encryption and Tokenization: Shielding Sensitive Data

- Encryption: From the moment a card is swiped, dipped, or tapped, the Square reader encrypts the card information using industry-standard protocols. This encryption scrambles the data, rendering it unreadable to anyone who might intercept it during transmission.

- Tokenization: An additional layer of security comes through tokenization. Instead of sending the actual credit card number to Square’s servers, a unique token is generated. This token acts as a pseudonym for the real card number and is used for authorization purposes. Even if someone were to intercept this token, they wouldn’t have the actual card details.

Discuss the Square ecosystem, including the Square Dashboard

Square’s card reader is just one piece of a comprehensive ecosystem designed to empower businesses. This ecosystem offers a suite of integrated tools that go beyond simple payment processing, streamlining operations and enhancing customer experiences. Let’s explore some key components of the Square ecosystem:

Square Dashboard: Your Business Command Center

The Square Dashboard serves as the central hub for managing your business. Accessible from any web browser, this online portal provides real-time insights into your financial performance. Here’s a glimpse into its functionalities:

- Sales Tracking: View detailed sales reports, analyze trends, and identify top-selling items.

- Inventory Management: Track inventory levels, receive low-stock alerts, and manage product variations.

- Employee Management: Create employee profiles, assign permissions, and monitor individual sales performance.

- Customer Management: Build a customer database, store contact information, and personalize marketing efforts.

- Reporting & Analytics: Gain valuable insights into your business health with customizable reports and data visualizations.

- Settings & Security: Manage your account settings, configure security protocols, and access customer support.

The Square Dashboard allows you to manage your business from anywhere, offering a centralized platform for vital tasks.

Square Register: A Point-of-Sale Powerhouse

While the Square app provides basic functionality for processing payments, businesses requiring a more robust point-of-sale (POS) system can opt for Square Register. This hardware-software solution combines a sleek touchscreen tablet with the Square Point-of-Sale app, offering a comprehensive POS experience:

- Enhanced Checkout: Process payments with ease, including contactless options like Apple Pay and Google Pay.

- Inventory Management: Manage inventory directly on the Register, scan barcodes for faster transactions, and adjust stock levels.

- Customer Management: Create customer profiles, track purchase history, and offer loyalty programs.

- Receipt Printing: Print customized receipts for customers or send them electronically.

- Tax Management: Configure tax rates for different products and locations.

Square Register integrates seamlessly with the Square ecosystem, allowing real-time data sync with your Square Dashboard for effortless management.

Integrated Power: A Connected Ecosystem

The beauty of the Square ecosystem lies in its interconnectedness. Data flows seamlessly between the Square Reader, Square Dashboard, and Square Register, providing a unified view of your business. Additionally, Square offers a marketplace of third-party apps that integrate with the ecosystem, allowing you to customize your experience based on specific needs. Whether you require appointment scheduling, email marketing tools, or loyalty program management, there’s likely an app to streamline your workflow.

Square’s ecosystem extends far beyond just a card reader. It empowers businesses with a suite of tools for managing sales, inventory, customers, and more. With a centralized dashboard, a robust POS system, and seamless integrations, Square offers a comprehensive solution for businesses to thrive in today’s dynamic market.

Conclusion: A Powerful Tool for Modern Businesses

Square card readers have become a popular choice for businesses of all sizes due to their simplicity, affordability, and robust security features. By understanding how these readers work, you can feel confident in accepting credit card payments on the go and take your business to the next level.