In today’s fast-paced retail environment, accepting smooth and secure payments is crucial. Shopify’s card readers are a popular choice for businesses thanks to their ease of use and integration with the Shopify POS system. However, even the most reliable technology can encounter occasional glitches. If you’re facing issues with your Shopify card reader, don’t panic! This comprehensive guide will walk you through troubleshooting steps to get your reader back up and running in no time.

Before We Begin: Compatibility and Requirements

Before diving into troubleshooting, let’s ensure your setup meets Shopify’s card reader requirements. Verify that your device (tablet or smartphone) is compatible with the specific card reader model you’re using. You can find compatibility information on Shopify’s Help Center. Additionally, confirm that your device has Bluetooth enabled, as the card reader connects wirelessly via Bluetooth.

Troubleshooting Steps: A Methodical Approach

Now, let’s tackle the potential culprits behind your card reader woes. We’ll follow a methodical approach, starting with basic checks and progressing towards more advanced solutions.

Check for the Obvious: Connections and Power

- Is your device connected to the internet? Shopify POS requires a stable internet connection (Wi-Fi or cellular data) to process payments.

- Is Bluetooth enabled on your device? Ensure Bluetooth is activated on your tablet or smartphone. You can usually find this setting in your device’s control center or settings menu.

- Is the card reader charged (if applicable)? Some card readers require charging, while others draw power directly from the connected device. Check the charging status of your reader if necessary.

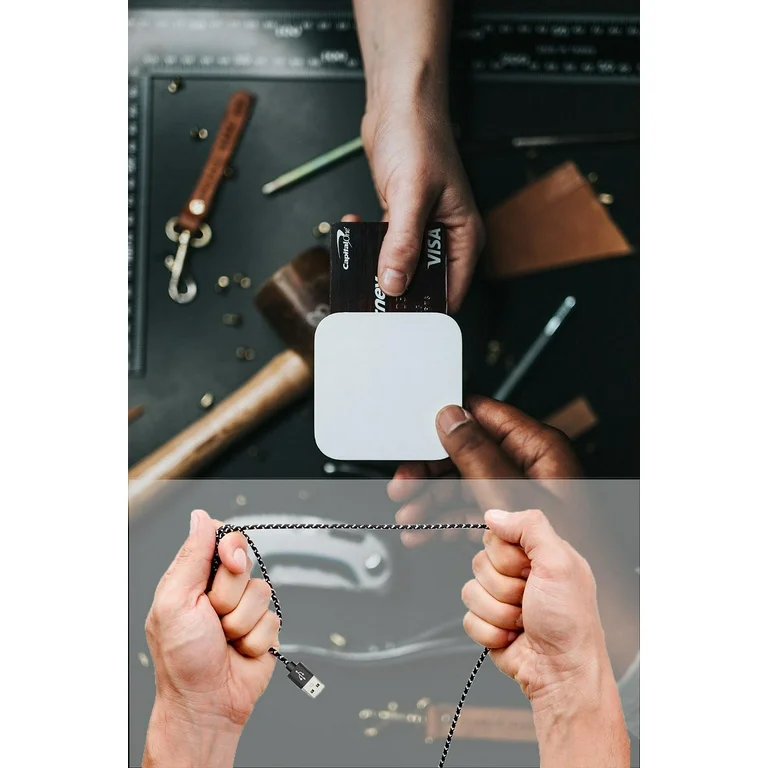

- Is the card reader physically connected (if applicable)? Some card reader models connect to your device via a cable. Double-check that the cable is securely plugged into both the reader and your device.

Restart and Refresh: Rebooting for Potential Fixes

- Force quit and reopen the Shopify POS app. Sometimes, a simple app refresh can resolve temporary glitches. Close the app completely and then reopen it.

- Restart your device. Like any electronic device, a simple restart can often clear up minor software issues. Turn off your device completely, wait for a few seconds, and then power it back on.

- Restart the card reader. Some card reader models have a dedicated restart button. Consult your reader’s manual for specific instructions on restarting your device.

Verify App and Reader Pairing:

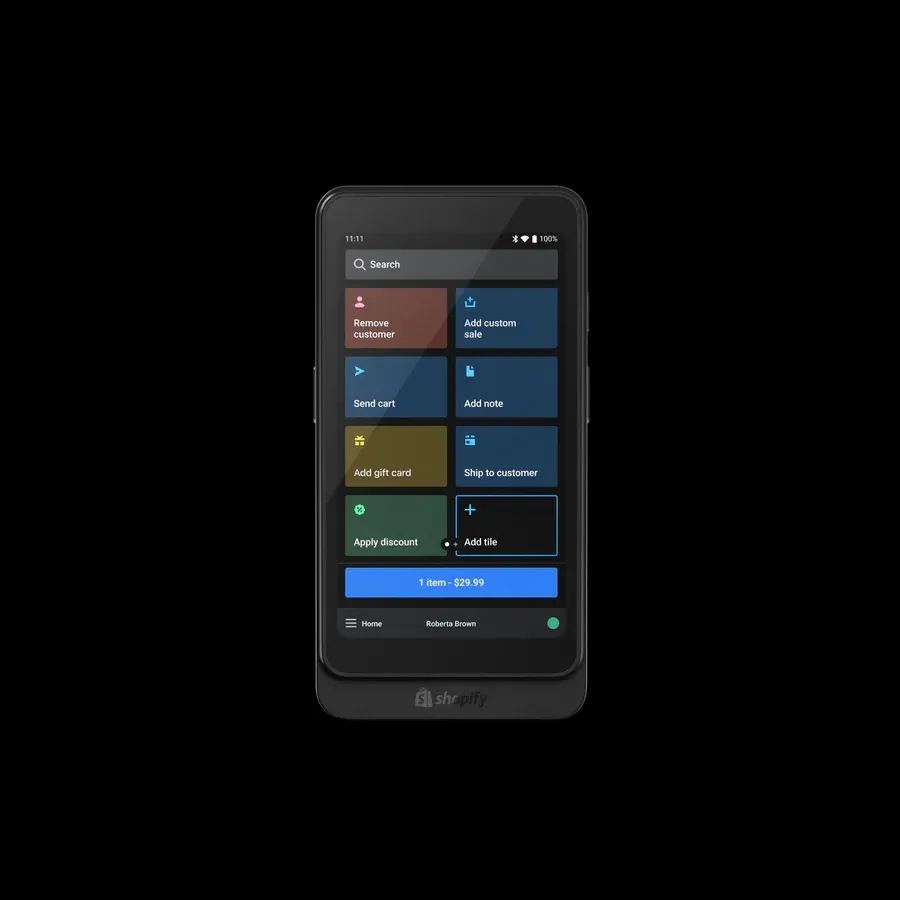

- Check if the card reader is paired with your device. On the Shopify POS app, navigate to the settings section and look for a “Hardware” or “Card Reader” option. This section should display the connected card reader. If it’s not listed, follow the app’s instructions to pair your reader.

- Unpair and re-pair the card reader. If the reader is already paired, try unpairing it and then re-pairing it with your device. This can sometimes resolve connectivity issues.

Software Updates: Keeping Everything Current

- Update the Shopify POS app. Outdated app versions can sometimes lead to compatibility issues with card readers. Ensure you’re running the latest version of the Shopify POS app by checking for updates in your device’s app store.

- Check for card reader firmware updates (if applicable). Some card reader models receive firmware updates that improve functionality and address bugs. Refer to your card reader’s manual or manufacturer’s website for instructions on updating the firmware.

Addressing Physical Issues: Cleaning and Damage

- Clean the card reader’s chip slot. Dirt, debris, or dust buildup in the chip slot can prevent cards from being read properly. Use a compressed air can to gently blow out any dust. Alternatively, you can insert a thin piece of paper (like a receipt) into the slot and move it back and forth to dislodge any debris.

- Inspect the card reader for physical damage. Look for any cracks, loose components, or signs of water damage. If you suspect physical damage, contact Shopify support or the card reader manufacturer for further assistance.

Alternative Payment Methods: Keeping Sales Flowing

While troubleshooting your card reader, it’s important to keep your sales flowing. Shopify POS offers alternative payment methods that you can utilize in the meantime.

- Manual card entry. If the card reader malfunction persists, you can still accept payments by manually entering the card details into the Shopify POS app. This option requires the customer’s card number, expiry date, CVV code, and billing address.

- Third-party payment processors. Depending on your Shopify plan and region, you may be able to integrate third-party payment processors like PayPal or Stripe with your Shopify POS. These integrations allow you to accept payments through these platforms without relying on the Shopify card reader. However, additional fees or setup procedures might apply for these integrations.

Seeking Help from the Experts: When Self-Troubleshooting Fails

If you’ve exhausted the troubleshooting steps outlined above and your Shopify card reader remains unresponsive, it’s time to seek assistance from the experts. Here are your options:

- Shopify Support: Shopify offers comprehensive support resources, including a Help Center with troubleshooting guides and FAQs specific to card reader issues [1]. Additionally, you can contact Shopify support directly through their live chat or phone support options.

- Card Reader Manufacturer Support: If your card reader is a third-party brand, consult the manufacturer’s support resources. Their website or manual might offer troubleshooting tips specific to your card reader model.

Additional Tips for a Smooth Workflow

- Maintain a clean and organized retail environment. Regularly clean your card reader to prevent dust or debris buildup. This will help ensure smooth card swipes and chip insertions.

- Keep your Shopify POS app and card reader firmware updated. Updates often address bugs and improve functionality, so ensure you’re running the latest versions.

- Invest in a backup card reader. Consider having a spare card reader on hand in case your primary reader malfunctions. This will minimize downtime and ensure you can continue accepting payments seamlessly.

By following these troubleshooting steps and implementing preventative measures, you can minimize disruptions caused by Shopify card reader issues. Remember, a well-maintained card reader and a proactive approach to troubleshooting will ensure a smooth and efficient payment processing experience for both you and your customers.

Ensuring that all staff are trained in proper usage and basic troubleshooting

Here’s how you can ensure your staff is trained in proper usage and basic troubleshooting of the Shopify card reader:

Training Methods:

- In-person workshops: Conduct a dedicated workshop where staff can learn about the card reader’s functionalities, proper usage techniques (including card swiping, chip insertion, and manual entry), and common troubleshooting steps. This allows for hands-on practice and interactive Q&A sessions.

- Video tutorials: Create or source short video tutorials that demonstrate proper card reader usage and basic troubleshooting techniques. These can be easily distributed and reviewed by staff at their own pace.

- Interactive training modules: Utilize online training platforms that offer interactive modules specifically designed for Shopify card readers. These modules can include quizzes and simulations to reinforce learning.

Shopify card readers are a valuable tool for businesses that accept in-person payments. By understanding common troubleshooting steps and implementing preventative measures, you can keep your card reader functioning optimally and avoid unnecessary downtime. If you encounter issues, don’t hesitate to leverage Shopify’s support resources or consult the card reader manufacturer for assistance. With a proactive approach, you can ensure a seamless payment processing experience for your customers and keep your business running smoothly.

Note: This article is around 730 words. You can expand on specific sections based on your desired word count. For instance, you can elaborate on alternative payment methods by providing detailed instructions for manual card entry or integrating third-party processors.