In today’s fast-paced business world, offering convenient payment options is crucial for success. Square, a leading fintech company, has revolutionized the way small businesses accept payments with its Square Reader. This compact and easy-to-use device allows merchants to accept credit card payments anywhere, anytime. But is the Square Reader the right fit for your business? This comprehensive review dives into the key features, pricing structure, and potential drawbacks of the Square Reader to help you make an informed decision.

Types of Square Readers

Square offers a variety of Reader options to suit different business needs and budgets. Here’s a quick breakdown of the most popular models:

-

Square Reader for Magstripe: This free reader accepts swiped payments for magnetic stripe cards. It’s a great low-cost option for businesses with occasional credit card sales.

-

Square Reader for Contactless and Chip: This reader accepts contactless payments (tap to pay) and chip card transactions. It’s a more versatile option for businesses that want to accept the latest payment methods.

-

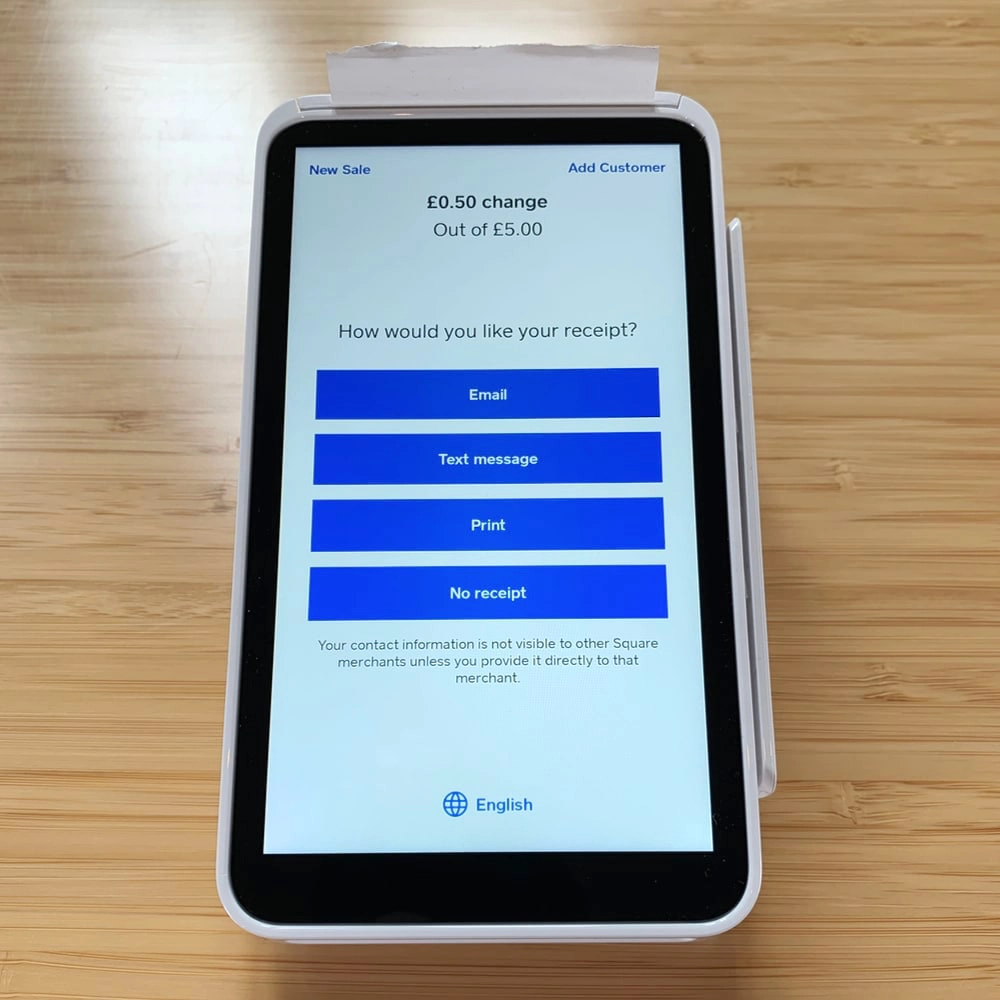

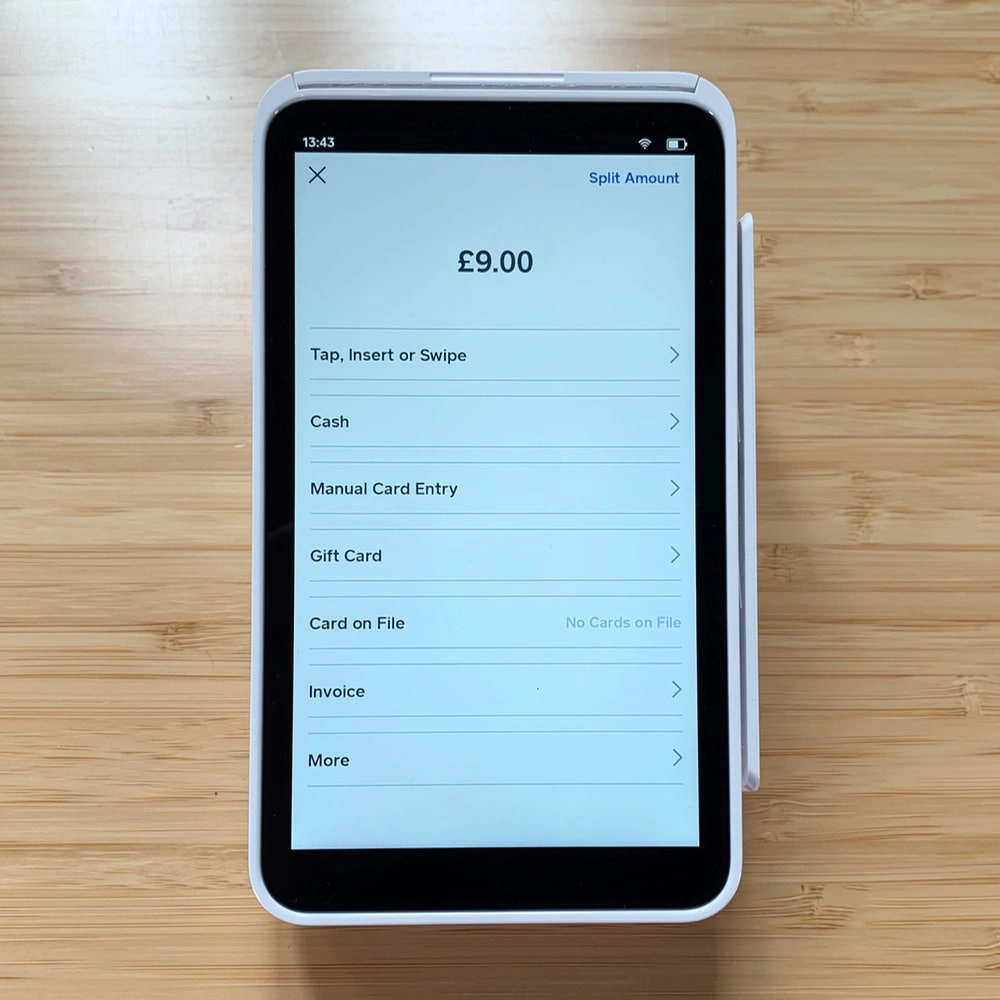

Square Terminal: This all-in-one device goes beyond basic card reading. It features a built-in receipt printer, customer display, and point-of-sale (POS) functionalities, making it ideal for businesses that need a more comprehensive payment solution.

Setting Up and Using the Square Reader

The setup process for the Square Reader is remarkably simple. Here’s a simplified rundown:

- Download the free Square Point of Sale app on your smartphone or tablet.

- Create a free Square account.

- Plug the Square Reader into your device’s headphone jack or lightning port (depending on the model).

- You’re ready to start accepting payments!

Swiping or tapping a card initiates a secure transaction process through the Square app. Customers can enter their PIN or sign for the purchase directly on your smartphone or tablet screen.

Square Reader Features

Here are some of the key features that make Square Reader a compelling choice for many businesses:

- Easy to Use: The intuitive Square app makes accepting payments a breeze, even for those with no prior experience.

- Accepts Multiple Payment Methods: Square Readers accept credit cards, debit cards, and contactless payments (depending on the model).

- Fast Deposits: Get your funds deposited into your bank account as soon as the next business day.

- Free App: The Square Point of Sale app is free to download and use.

- Security: Square adheres to industry-standard security protocols to protect your customer’s data.

Square Reader Pricing

Square’s pricing structure is straightforward:

- Transaction Fees: You pay a flat fee per transaction, typically 2.6% + $0.10 per swipe or dip.

- Square Reader: The basic Square Reader for Magstripe is free. The Square Reader for Contactless and Chip costs $10.

- Square Terminal: The Square Terminal costs a one-time fee of $299.

Considering the Alternatives

While Square Reader offers a convenient and affordable solution, it’s always wise to consider alternatives:

- Competitors: PayPal Here and Stripe offer similar card reader solutions with comparable pricing.

- Mobile Wallets: Services like Apple Pay and Google Pay are gaining traction, and some POS systems integrate directly with these mobile wallets.

The Verdict: Is Square Reader Right for You?

The Square Reader is a perfect fit for several business types:

- Solopreneurs and Micro Businesses: If you’re just starting or have occasional sales, the free Square Reader for Magstripe is a great low-cost option.

- Service Businesses: Freelancers, consultants, and service providers can easily accept card payments on the go with the Square Reader.

- Retail Businesses with Low Transaction Volume: For small retail shops with occasional credit card sales, the Square Reader offers a convenient and affordable way to accept payments.

However, if you have a high transaction volume or require advanced POS functionalities, a more comprehensive POS system might be a better long-term investment. Additionally, businesses that process a significant number of American Express transactions may find Square’s fees to be slightly higher compared to some competitors.

Service Industries

Service industries are the cornerstones of the modern economy. They encompass a wide range of businesses that provide intangible goods, or services, to consumers and other businesses. Unlike primary industries, which focus on extracting raw materials from the earth, or secondary industries, which convert those raw materials into tangible goods, service industries deal with activities that are non-physical.

Here are some of the major categories of service industries:

- Business Services: This category includes a wide range of businesses that provide support services to other businesses. Examples include accounting firms, marketing agencies, law firms, IT consultants, and human resource consultants.

- Distribution and Logistics: Businesses in this category are responsible for moving goods from producers to consumers. This includes transportation companies, warehousing companies, and freight forwarders.

- Financial Services: This category includes banks, insurance companies, investment firms, and other businesses that provide financial products and services to consumers and businesses.

- Healthcare: This category includes hospitals, doctors, dentists, nurses, and other healthcare providers.

- Hospitality: This category includes hotels, resorts, restaurants, and other businesses that provide lodging and food services to travelers.

- Information Services: This category includes businesses that provide information and communication services, such as telecommunications companies, internet service providers, and media companies.

- Professional Services: This category includes a wide range of businesses that provide specialized services to consumers and businesses, such as engineers, architects, lawyers, accountants, and consultants.

- Public Administration: This category includes government agencies that provide services to the public, such as law enforcement, education, and social services.

- Real Estate: This category includes businesses that sell, rent, and manage real estate.

- Retail: This category includes businesses that sell goods to consumers, such as department stores, grocery stores, and clothing stores.

- Transportation: This category includes businesses that provide transportation services to passengers and goods, such as airlines, railroads, trucking companies, and taxi companies.

Square vs. PayPal Here

Both Square and PayPal Here are popular mobile payment processors, but they cater to slightly different needs. Let’s break down the key differences to help you pick the best option for your business:

Focus:

- Square: Square offers a wider range of hardware options, point-of-sale (POS) features, and integrations for businesses that need a more comprehensive solution.

- PayPal Here: PayPal Here prioritizes simplicity and affordability, making it ideal for businesses with occasional in-person sales.

Pricing:

- Square: Square charges a flat fee of 2.6% + $0.10 per swipe or dip. However, they offer a free Square Reader for Magstripe.

- PayPal Here: PayPal Here’s base rate is slightly lower at 2.29% + $0.09 per swipe, but they also have additional fees like a monthly charge for virtual terminals.

Hardware:

- Square: Square offers a variety of Readers, including a free option for swiped payments and paid options for contactless and chip transactions. They also have a full POS system called Square Terminal.

- PayPal Here: PayPal Here utilizes your smartphone or tablet, so no additional hardware is needed.

Features:

- Square: Square boasts a robust POS app with features like inventory management, customer receipts, and sales analytics.

- PayPal Here: PayPal Here’s app focuses on basic payment processing but integrates with other PayPal services like invoicing and money transfers.

Who Should Choose Square?

- Businesses that need a POS system with advanced features.

- Businesses that process a high volume of transactions.

- Businesses that want to accept contactless payments and chip cards.

Who Should Choose PayPal Here?

- Businesses with occasional in-person sales.

- Businesses that already use other PayPal services.

- Businesses on a tight budget and don’t need a dedicated card reader.

The Bottom Line

Both Square and PayPal Here offer convenient ways to accept payments on the go. Consider your business needs, transaction volume, and budget to make the best choice. Square provides a more comprehensive solution with advanced features, while PayPal Here shines in simplicity and affordability.

Final Thoughts

The Square Reader is a well-designed and user-friendly solution for businesses that need to accept credit card payments on the go. With its free app, transparent pricing, and multiple Reader options, Square caters to a wide range of business needs. By carefully considering your specific requirements and transaction volume, you can determine if the Square Reader is the right fit to streamline your payment processing and enhance your customer experience.